It’s Not Just Subsidies: How China’s EV Battery Firms Learned Their Way to Dominance

It’s Not Just Subsidies: How China’s EV Battery Firms Learned Their Way to Dominance [ 5 min read ]

Insights

- Analysis of comprehensive EV and battery sales data from 13 countries (2013–2020) shows that “learning by doing” — the practical experience gained from producing more of something — cut battery costs by 42%, greater than industry-wide tech upgrades (34%) and other factors like economies of scale.

- EV purchase subsidies in the U.S., EU, and China combine with learning by doing in a positive feedback loop: more sales mean more production experience, raising EV sales in the 13-country sample by over 200%.

- China’s domestic content requirements for EV subsidies drove local firms BYD and CATL to scale up quickly. The resulting production experience helped their batteries get cheaper faster than international rivals like Panasonic and Samsung, though the timing of this policy during a technological "catch up" period was key to its success.

- U.S. and EU subsidies created welfare gains for consumers and firms in Japan and South Korea (e.g., automakers, battery producers). China kept 93% of welfare gains due to low EV imports and domestic battery sourcing.

Read this brief on SUBSTACK

In recent years, a handful of companies — primarily from China (e.g., CATL, BYD), South Korea (e.g., Samsung, LG), and Japan (e.g., Panasonic) — have dominated the EV battery market. When China implemented a policy in 2016 restricting subsidies to EVs using batteries from approved domestic suppliers, domestic firms saw their sales grow significantly faster than their Japanese and Korean competitors. As these firms ramped up production and gained experience, the EVs using their batteries became cheaper more quickly than those using foreign batteries. The impact extended beyond China: the share of EV models outside China using Chinese batteries rose from nearly zero in 2016 to 4% in 2019, then surged to 11% in 2020 — and has grown ever since. What explains the rapid global expansion of batteries from China’s firms?

The data. The authors estimate how much battery makers cut costs through production experience alone, distinct from industry-wide technology upgrades and economies of scale. Using EV sales, prices, battery types, and supplier data from 13 countries (2013–2020), they work backward from vehicle prices to infer true battery costs and assess how policies shape sales and production. By comparing firms that gain experience from sudden policy changes (e.g., domestic content requirements favoring local firms) with those that don’t, they isolate the impact of experience on costs and show how government policies and global supply chains amplify these effects.

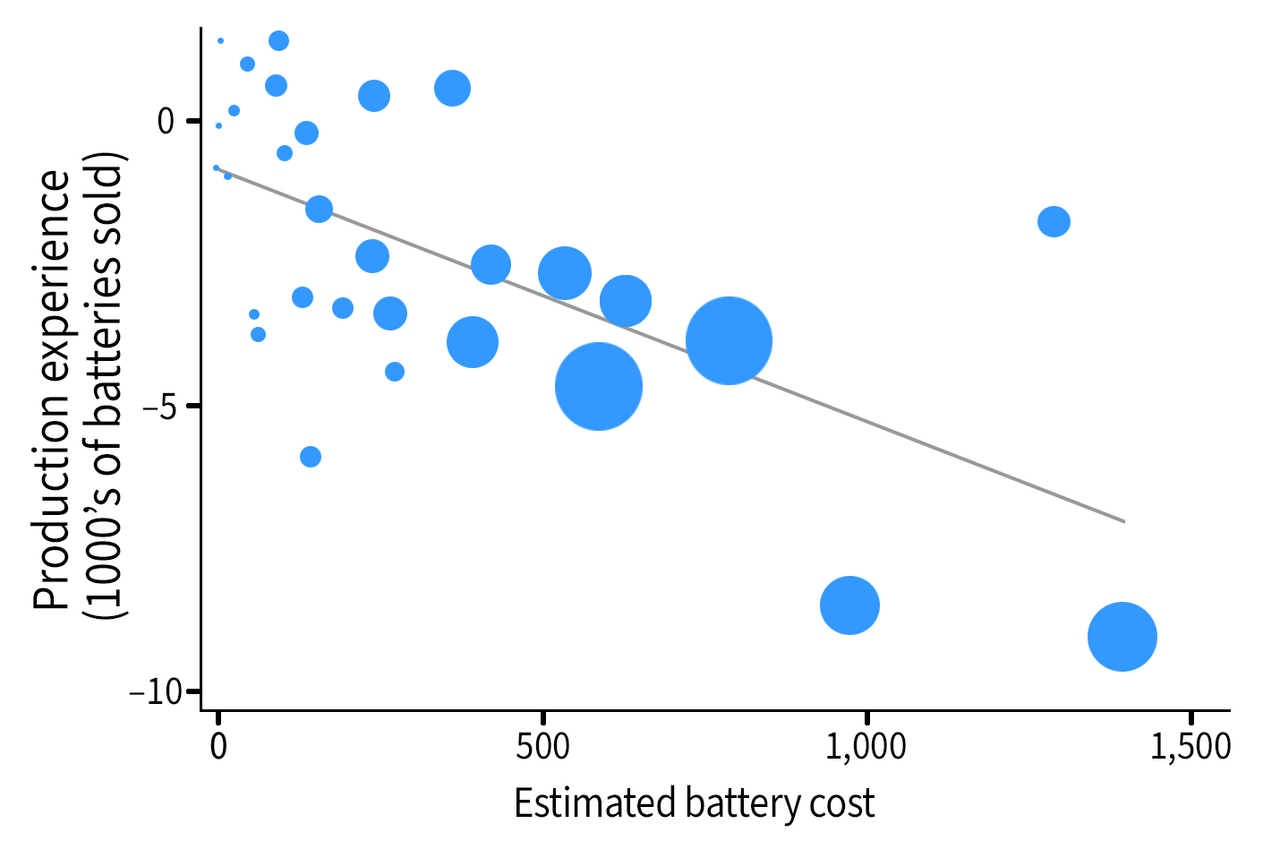

Experience from making more batteries is a major driver of cost reductions. The learning that occurs when building more batteries reflects a mix of practical improvements that come with experience. These can include streamlining the assembly of battery cells and packs, reducing waste and defects, improving yields of costly inputs like lithium, nickel, and cobalt, fine-tuning or upgrading equipment, building a workforce with key skills, and refining supply chains to source materials more efficiently. The researchers find that every time a supplier doubled its cumulative battery output between 2013 and 2020, its costs fell by 9.2% on average. This learning-by-doing effect accounts for 42% of the total cost drop during that period. Another 34% of cost reductions came from industry-wide technological advances, with the rest explained by shifts in battery chemistry, input costs, and economies of scale. These findings highlight the key role of production experience: the more firms produce, the more opportunities they have to improve their processes, reduce waste, and cut costs.

Battery cost versus battery production experience

Note: Size of blue dot corresponds to amount of consumer EV subsidy

Production experience amplifies the sales impact of consumer EV subsidies. The researchers’ model identifies a powerful feedback loop: consumer EV subsidies boost sales, which builds battery production experience, driving down costs and prices — further fueling adoption. They find that from 2013 to 2020, consumer subsidies alone increased global EV sales by 27.9% (0.83 million units), while production experience alone added 95% (2.83 million units). But together, consumer subsidies and production experience drove a 204% surge in sales (6.06 million units) — a combined effect nearly 70% greater than the sum of each alone, underscoring their complementarity.

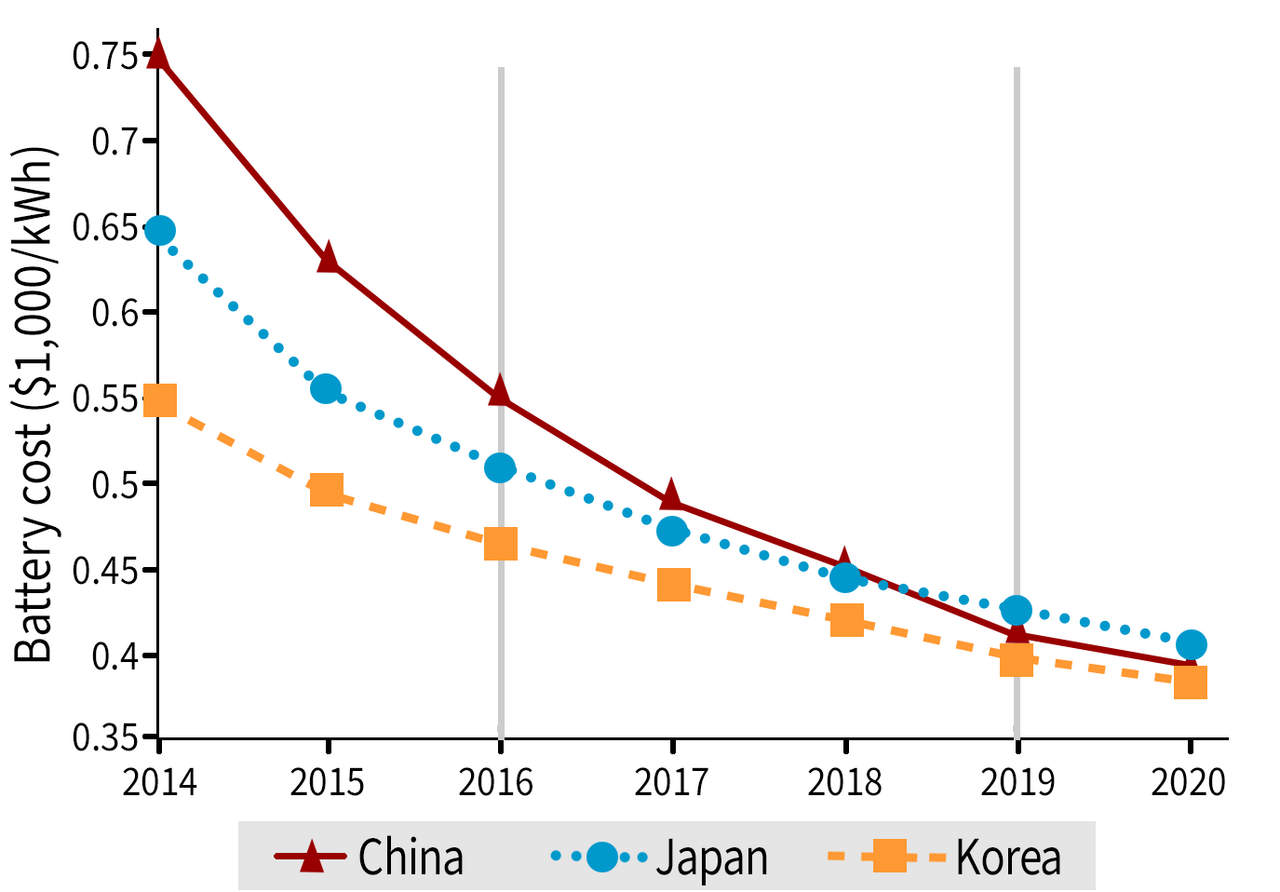

Battery cost reductions by country

When supply chains overlap, EV consumer subsidies in one country help consumers and firms worldwide. The researchers assess the effect of EV consumer subsidies in the U.S., EU, and China. They estimate that $13.1 billion in U.S. subsidies of the Inflation Reduction Act (IRA) generated an additional $16.5 billion in global benefits to consumers and firms (e.g., automakers). The U.S. and Canada captured 49% of these gains through lower domestic battery costs and EV prices, while Japanese and South Korean battery exporters captured 28%. Few gains from the IRA reached China’s producers or consumers due to limited trade and supply chain links. Similarly, EU subsidies of $16.4 billion produced a net $11.6 billion in global gains, but the EU only captured 26% of the gains due to high EV imports and less effective consumer subsidy design. By contrast, China retained almost all (92.6%) of the welfare gains of its subsidies thanks to low EV imports and domestic battery sourcing.

Domestic content requirements helped China, though timing was key. In 2016, China introduced a policy that only gave EV purchase subsidies to vehicles using batteries from certain Chinese suppliers (BYD and CATL). This boosted domestic battery makers but cost other countries: the EU, Japan and South Korea, and the U.S. and Canada together lost an estimated $7.64 billion in welfare because production for China’s consumers shifted from more efficient Japanese and South Korean firms to, at the time, higher-cost Chinese producers. Inside China, battery companies gained, but consumers paid higher EV prices, and carmakers initially lost out before benefiting later as more sales helped domestic firms learn faster and cut costs. China’s domestic content rules were well timed for when the “catch up” gains from battery production experience were particularly high for domestic battery producers. Had they occurred later, the researchers find, the policies would have hurt China’s consumers more than they aided local firms.

Learning your way to the top. The analysis shows that companies improving their battery production simply by making more of them is a major driver of falling costs, exceeding even advances in technology. This means that policies boosting EV sales can have far greater long-term effects than they appear at first, because each extra unit sold not only meets current demand but also helps lower future prices through accumulated experience in EV battery production. These cost reductions can spill across borders via global supply chains, amplifying benefits in other countries, but who gains depends heavily on trade patterns and supplier networks. China’s well-timed domestic content restrictions helped its battery firms get cheaper faster than their international rivals, while its limited EV imports and domestic battery sourcing meant most of the benefits accruing from “learning by doing” stayed at home.