How Anticorruption Enforcement Shapes R&D Subsidies and Firm Innovation in China

How Anticorruption Enforcement Shapes R&D Subsidies and Firm Innovation in China [ 5 min read ]

Insights

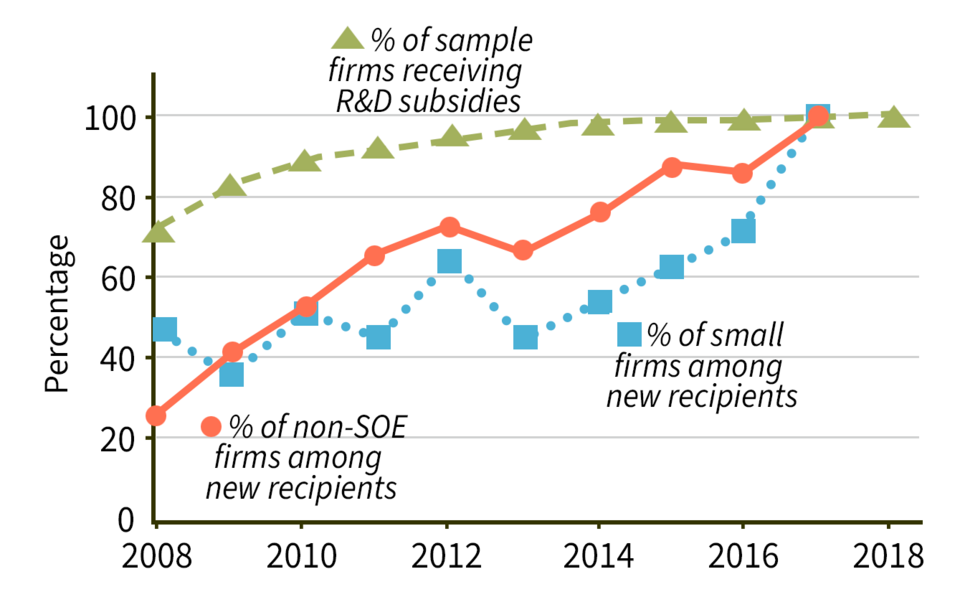

- Analysis of firms that comprise 82% of China’s R&D expenditures reveals that by 2018, 99% of firms had received R&D subsidies from the government. Sixty-four percent of subsidies were dispersed by provincial or local-level officials.

- In studying the removal of 42 provincial level officials for corruption, researchers find that before their removals, corruption played a stronger role than a firm’s innovative merit in predicting the amount of government subsidies a firm received.

- Following the removal of the officials, government subsidies were allocated more on the basis of firm merit, leading to significant gains in the innovative output of subsidized firms.

- The analysis concludes that anticorruption can improve the efficiency of government subsidy programs and enhance their intended outcomes on innovation and economic development.

Source Publication: Lily Fang, Josh Lerner, Chaopeng Wu, and Qi Zhang (2023). Anticorruption, Government Subsidies, and Innovation: Evidence from China. Management Science.

One fifth of R&D expenditures of China’s firms comes from government subsidies. While research grants in the West are typically evaluated by independent scientific panels, R&D subsidies in China are primarily allocated by local government officials. In 2020, for example, subnational-level government officials were collectively in charge of 580 billion yuan in annual funding, representing 64.3% of total government R&D subsidies. To what extent does corruption in China weaken the link between R&D subsidies and firm innovation?

The data. Researchers examined how R&D subsidy allocation was affected by the removal of 42 top provincial officials due to anticorruption enforcement between 2012 and 2018 and 52 cases of unexpected changes in leadership within provincial technology bureaus that were largely responsible for R&D allocation between 2007 and 2018. Researchers manually compiled the lists of unanticipated departures and removals of leaders using government websites, newspaper reports, and postings and announcements about personnel movements from the Chinese Communist Party’s Organization Department. Next, researchers sampled firms listed on the Shanghai and Shenzhen stock exchanges in industries that previous research has shown to be R&D intensive. Data on firm-level R&D subsidies were collected from a firm’s annual report, as listed firms are required to disclose the type and amount of government subsidies received. Firm corruption was proxied by tallying a firm’s entertainment and travel costs as a proportion of revenue. Although these costs contained legitimate business expenses, there is significant latitude in how employees claim expenses, making this accounting item indicative of corruption. Finally, data on firm merit and innovation were collected from InnoJoy, a commercial database providing patent information for Chinese firms.

Subsidies among sample firms

Government subsidies pervasive in R&D intensive industries. Researchers focused their analysis on firms in R&D intensive industries, including petrochemicals, electronics, metals and materials, machinery and equipment, pharmaceuticals and biotechnology, and information technology. These firms collectively represented 56% of the total market capitalization of China’s A-share market (excluding the financial sector), 82% of its total R&D expenses, and 89% of its U.S. patents between 2007 and 2018. Researchers found that by 2018, 99% of these firms had received R&D subsidies.

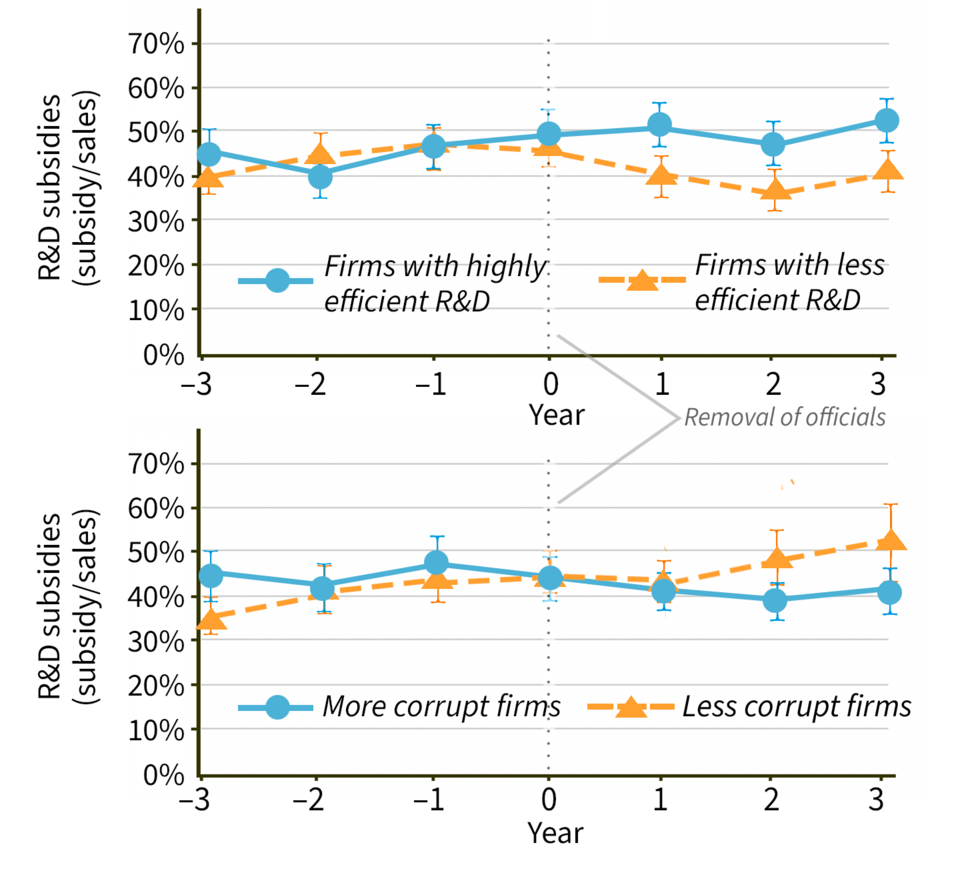

Before anticorruption enforcement, subsidies linked more to corruption than firm merit. The researchers proxied “corruption” by tallying a firm’s entertainment and travel costs as a proportion of revenue. They proxied a firm’s “merit” by comparing the number of successfully filed invention patents to its R&D expenditure, which indicates how efficiently a firm is turning its investment in R&D development into new inventions. In the aggregate, higher firm corruption and merit were both associated with a rise in subsidies to firms. But once researchers controlled for individual firm characteristics, firm merit was only weakly linked to the receipt of subsidies. These findings suggest that when overall levels of corruption were higher, both merit and corruption affected subsidies, but that corruption played a stronger role and firm merit played a weaker role.

After anticorruption enforcement, firm merit drives more subsidies, innovation increases. The central government’s anticorruption campaign and unexpected changes in leadership within provincial technology bureaus both decreased overall levels of corruption. This decline sharply increased the relative impact of merit and simultaneously decreased the influence of corruption on subsidy allocation. After the decline in corruption, the researchers found that a one standard deviation increase in subsidies (as a percentage of sales) was associated with a 56% increase in future innovation, as proxied by a firm’s U.S. patenting rates. This effect was more pronounced in industries particularly reliant on subsidies (rather than loans, for instance) for their R&D efforts and in provinces that had low capital availability.

Subsidies before and after removal of top provincial officials on corruption charges

Anticorruption enforcement deters corruption-based subsidy allocation. After the anticorruption enforcement, officials were less likely to allocate subsidies on the basis of corruption, even in provinces where government officials were not replaced. However, the threat of the anticorruption campaign did not make officials more likely to allocate subsidies based on firm merit across the board. Thus, the threat of the anticorruption campaign seemed to have a deterrence effect on corruption but did not lead to more merit-based decisions in the aggregate.

Firms benefit from anticorruption efforts. This study finds that in China’s system, wherein government bureaucrats are responsible for distributing R&D subsidies, corruption led to resource misallocation with negative implications for firm innovation. However, following the 2012 anticorruption enforcement and unexpected changes in leadership within provincial technology bureaus, the allocation of subsidies was more closely linked to a firm’s actual merit rather than corrupt practices, with a marked improvement in the association between subsidies and future innovation. Taken together, this study provides evidence that corruption in China’s R&D ecosystem weakens the link between the government’s R&D subsidies and innovation.